We all know insurance companies like to insert themselves into just about every aspect of health care. Many insurance plans make you go to an approved doctor at an approved hospital for approved procedures and take approved drugs. Fee-for-service docs don’t have much say here. They’ve handed all this control to insurance companies and the insurance companies use it, they say, to control their own costs. But is that all they use it for?

About a year ago David Belk prescribed cyclobenzaprine, a commonly-prescribed muscle relaxant, for a patient who had recently strained her back. About two hours after she left his office, he writes, Walgreens (her pharmacy) faxed him a message.

According to Walgreens, this medication was not covered by the patient’s insurance (Healthnet). But they agreed to cover baclofen, another commonly-prescribed muscle relaxant, for a $12 copay.

This fax meant, first, that Belk’s patient went home without their medication, and second, that she wouldn’t get any medication until he either switched her prescription to the drug that Healthnet “approved” or filled out a form requesting an exception for this particular patient for this particular drug. If he doesn’t check his fax machine routinely (add that to the list of neurotic behaviors associated with fee-for-service care: copious EMR mouse clicks, ICD-10 codes for suicide by jellyfish…), this patient isn’t getting any medication that day.

This denial seems odd, right? Doctors, we know that cyclobenzaprine has been generic for years now. Clinically there’s little difference between it and baclofen. How is this a cost issue? Let’s check out the price of each medication at Costco.com.

As you can see, both medications cost less than the $12 copay, meaning the insurance company wasn’t “covering” anything. Better yet, the one he prescribed was cheaper. So why were they being so obstinate? Worse yet, even though his patient could afford the medication herself — for less money than the copay her insurance plan required — she wasn’t allowed do it at Walgreens. At many chain pharmacies, if you show them an insurance card, you’re forced to play by your insurance company’s rules.

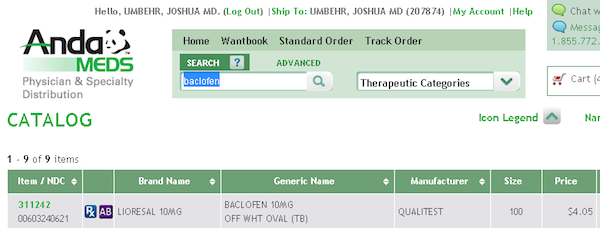

Now what happens if this patient had access to a Direct Care physician who offered wholesale prescriptions?

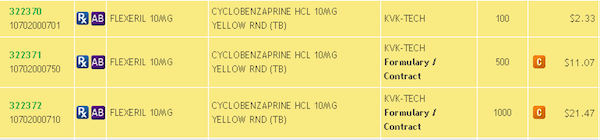

In the case of cyclobenzaprine (see top line: 100 pills for $2.33), we’re talking 2 CENTS PER PILL. Or 60 cents per month.

And if you want the name brand baclofen (100 pills for $4.05), you can pay 4 CENTS PER PILL. Or $1.20 per month.

If you want, sure, go ahead and pay the $12 copay. But we don’t know why anyone would want to use insurance in this situation, except that insurance WANTS YOU TO USE THEM EVERYWHERE YOU GO. Imagine if you were a toll road company. Do you want people taking surface streets? Or taking the bus? Or taking the subway? No. You want them on your toll roads. That is insurance in a nutshell, an exceedingly complex toll road to limitless destinations. They profit off our own resistance to finding paths that are as effective and more cost efficient.

Oh, and insurance companies will invent roadblocks.

Just ask Belk. He’s had multiple problems with insurance companies stymying his simple efforts to get his patients their prescriptions. Cigna has sent him letters stating they won’t cover cyclobenzaprine, Blue Shield told him they would’t cover hydroxyzine, and other insurance companies have denied pantoprazole and metoprolol tartrate — all very inexpensive generic medications. In each case the message was the same: Sorry, the patient’s insurance plan doesn’t “cover” this more affordable medication.

Can we stop for a minute and admit that this is insane? This defies the marketplace. You don’t go to 7/11 to buy a hot dog and get told, “Sorry. Your cash can’t buy this $1 all-beef hotdog. You can only buy this $2 one that’s wrapped in bacon.”

But if these medications don’t cost very much, why all these denials? And what does this tell us about the role of health insurance in our lives?

Health care is the only industry in the U.S. where we go through an insurance company to purchase nearly everything no matter how trivial or mundane. You don’t use your car insurance when your check-engine light comes on, but you use your health insurance to pay for a blood test. How did we let this happen??

The relationship people have with their insurance company is like an addiction — it’s irrational, the easy path, fear-based, and has poor results. Most people — and even doctors — had no idea or have lost track of what anything in health care really costs. Not knowing what you pay for something is a huge disadvantage. The more you depend on an intermediary (like a health insurance company), the more money they can extract for the dependence. They keep you confused so you can’t break away. They profit off our collective ignorance.

By refusing to cover a medication, the insurance company sends both the doctor and patient a message: “All of your medical costs are very high. You need us.” It works because, as a population, we don’t know when a test or medication is really just the same price as an oil filter. Insurance companies craft this illusion of “high cost” to justify their premium prices. As long as neither doctors nor patients are willing to look up the actual price of these products, no one will see through their deception. Clever, right? Wrong. We have a comprehensive list of wholesale prices that we charge, right here.

Can you blame an insurance company for trying to manage its own costs? But they’re playing real hardball when they start to extract money directly from patients by getting them to overpay for medical services. And in these examples, they’re refusing a medical service altogether, and without just cause. If health insurance companies are going to directly interfere with your medical care just to profit, why don’t you stop playing so much ball with them? And if you can’t find direct care in your town, then sign up here, and let it be known that you want a local team that offers insurance-free primary care.