For years, DPC doctors and patients have faced an unnecessary hurdle: federal rules created uncertainty around whether a DPC membership could be combined with a Health Savings Account (HSA), and many people avoided doing so.

That’s changing.

Since the passing of the “One Big Beautiful Bill Act”, DPC will finally be recognized for what it is: a direct medical service. Patients will be able to pair DPC memberships with high-deductible health plans (HDHPs) and use their HSAs to pay for DPC, all without jeopardizing their HSA eligibility.

This guide will give you everything you need to know about HSAs, what’s changing, how these changes affect your patients, employers, and DPC as a whole, and how to communicate these changes effectively.

Let’s break it down.

What Is an HSA?

An HSA is a tax-advantaged account available to patients with an HDHP. Patients contribute pre-tax dollars, let that money grow tax-free, and withdraw funds tax-free for qualified medical expenses.

For 2025, the IRS has set contribution limits at $4,300 for individuals and $8,550 for families, with an additional $1,000 “catch-up” allowance for those age 55 and older.

Unlike a flexible spending account (FSA), the money in an HSA rolls over year after year; there’s no “use it or lose it.”

The account is portable, meaning it belongs to the patient rather than their employer, and it also offers retirement flexibility. After age 65, funds can be withdrawn for non-medical expenses and are taxed the same as ordinary retirement income.

Together, these features make an HSA much more than a short-term spending tool. For many patients, it functions as both a healthcare fund and a long-term savings vehicle.

How HSAs Work in Practice

Most patients use their HSA for everyday qualified expenses, such as office visits, prescriptions, lab tests, mental health care, and medical devices. HSAs function almost like a debit card, except with the bonus of tax-free spending.

There’s also a retirement twist: once a patient turns 65, HSA withdrawals for non-medical expenses are simply taxed like regular retirement income. That means an HSA acts like a hybrid: part health fund, part retirement account.

For everyday care, though, the main value is straightforward: patients use pre-tax dollars to pay for the care they need, when they need it.

What’s Changing

For years, many patients wanted to know if they could use their HSA to pay for their DPC membership. They could use HSAs for labs, imaging, or prescriptions ordered through their DPC doctor, but not the membership fee itself.

However, DPC will soon be formally recognized as a qualified medical expense under federal law. In practical terms, this means patients will be able to use HSA funds to pay for their monthly DPC memberships, just as they would for any other direct healthcare service.

On top of that, patients enrolled in DPC who also have a qualified high-deductible health plan will be allowed to contribute to an HSA. This means they’ll be able to enjoy the simplicity of direct care and the tax advantages of an HSA.

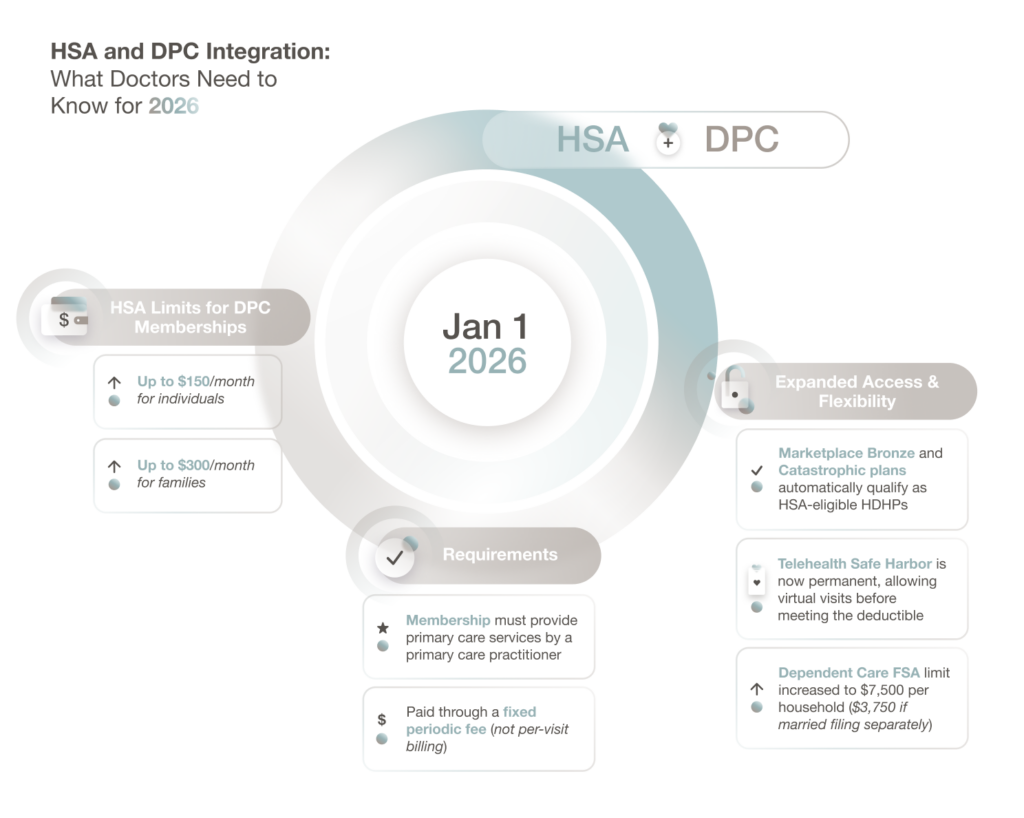

The law also sets clear financial and scope limits for qualifying DPC arrangements:

- Patients can use HSA dollars for up to $150 per month for individuals or $300 per month for families, indexed for inflation.

- The membership must provide primary care services by a primary care practitioner, paid via a fixed periodic fee, not per-visit billing.

The legislation also expands access in a few key ways:

- Bronze and Catastrophic marketplace plans will automatically qualify as HSA-eligible HDHPs, giving more patients access to the DPC + HDHP + HSA combination. This change applies to individual marketplace plans, not the Small Business Health Options Program or small-group exchanges.

- The telehealth safe harbor is now permanent, allowing patients to use telehealth services— including DPC virtual visits—before meeting their deductible without affecting HSA eligibility.

- The Dependent Care FSA limit increases from $5,000 to $7,500 per household (or $3,750 if married filing separately) and is not indexed for inflation. This gives employers more flexibility when designing benefits.

The IRS will issue additional guidance in the coming months to clarify documentation standards and reimbursement procedures. We expect to see specifics on:

- How clinics should itemize HSA-eligible charges

- How patients can substantiate claims if audited

- How the monthly caps will adjust for inflation

Basically, the framework is set. Now, we’re waiting for the fine print.

What This Means for Your Clinic

You don’t need to overhaul your practice, but a few smart updates will set you up for success.

The goal is to make your DPC structure crystal clear: you provide medical care, not insurance. That distinction will matter when patients start using their HSAs for membership payments.

Here’s how to prepare:

- Offer clear, itemized invoices. Some patients will need statements to submit for HSA reimbursement; others may pay directly with an HSA debit card. Transparent, consistent invoices make it easy either way.

- Educate your patients early. A brief email or handout explaining what’s changing and when will position your clinic as a trusted guide. Consider including the $150/$300 HSA caps so patients understand the rules upfront.

These are minor adjustments, but they’ll save you time, strengthen compliance, and demonstrate to patients that you’re ready for the next chapter of DPC.

Opportunities with Employers and HDHPs

This change doesn’t just benefit individual patients; it opens a huge opportunity for employer partnerships. For years, many small businesses have sought to combine DPC with HDHPs, but the HSA restrictions have made that combination legally murky.

Now, that barrier is gone. Employers can confidently build benefit packages that blend:

- DPC for everyday, relationship-based primary care

- An HDHP for catastrophic or hospital coverage

- An HSA for tax-free healthcare spending

And with ACA Bronze and Catastrophic marketplace plans now classified as HSA-eligible HDHPs, more employees than ever can participate in these plans.

Together, these pieces form a comprehensive, affordable system, one that rewards prevention and puts doctors, not administrators, back at the center of care.

For DPC clinics, this opens new opportunities to partner with local employers. You can approach them not just as healthcare providers, but as strategic allies in lowering costs and improving access. Employers save money, employees get better care, and your practice becomes the foundation of a healthier, more sustainable benefits model.

How to Communicate the Change to Patients

Patients may not be familiar with the finer points of HSAs, so it helps to keep the explanation simple. One way is to frame the account as a kind of “tax-free health wallet.” They put money in before taxes, and when they spend it on medical care, they don’t owe taxes on it at all.

Explain how that money can be used to pay directly for their DPC membership. That means patients no longer have to think of DPC as separate from their health benefits; it’s fully part of their HSA strategy.

You might say something to the point like:

“Beginning in 2026, you’ll be able to use your HSA to pay for your DPC membership. You’ll keep your high-deductible plan for major coverage and use your HSA for ongoing primary care, all while saving on taxes.”

To make communication easy, consider a few quick steps:

- Create a short FAQ or handout. Explain what’s changing, when it takes effect, and how patients can use HSA funds to cover their membership up to the federal limits of $150/month for individuals or $300/month for families.

- Add a note to your website or onboarding materials. A short paragraph or banner update can reassure both new and existing members that your clinic is ready for the change.

- Plan an email or text update once IRS guidance is final. A “Here’s what this means for you” message with a link to your FAQ will go a long way.

Your patients don’t need the legal fine print. They just need to know that the care they already love is about to get even easier to manage, and that you’ve got them covered every step of the way.

It can also be useful to paint the bigger picture. An HDHP handles catastrophic events, DPC provides everyday care, and the HSA ties it all together by offering patients a tax-advantaged way to fund both.

Encouraging patients to contribute regularly—even modest amounts—helps them build a cushion that covers not only routine care but also unexpected needs.

Why This Matters for the DPC Movement

This isn’t just a regulatory update: it’s a validation of everything DPC doctors have been building toward for years.

For years, DPC physicians have built a model centered on time, transparency, and trust, long before policymakers caught up.

With this legislative change, that commitment is being reflected at the national level. The law now makes clear that what happens inside your practice is medical care, not insurance.

Allowing HSA funds to be used for DPC memberships means patients can now invest pre-tax dollars in preventive, relationship-based care, the kind that keeps them healthier, longer.

And for the DPC community, it’s a turning point. It demonstrates that a grassroots, patient-first approach can influence federal policy, showing that when care is personal, it can scale.

This recognition doesn’t redefine DPC; it reinforces it. The system is simply catching up to what DPC doctors have been doing all along: delivering meaningful, measurable care without middlemen.