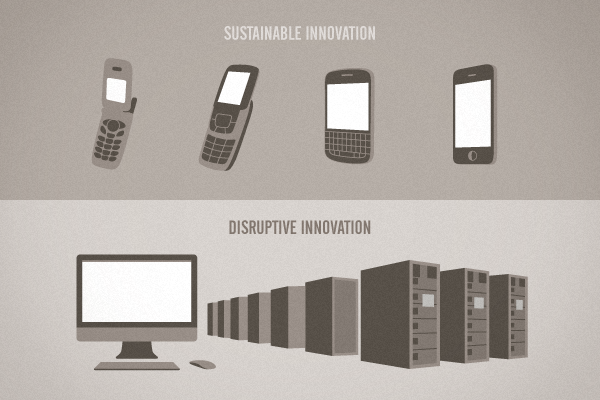

The Clayton Christensen Institute For Disruptive Technology is a think tank that understands how different products can actually start small and grow into prominence in the marketplace. You can read their reasoning for why EHR is not disrupting the marketplace here. Their article explain why most EHR offerings are just a more expensive way to do what paperwork is already doing. This fact, coupled with government incentives, makes for what they call a sustaining model, where each year you are offered new, more expensive products that are hardly an improvement from the year before. In the end, it’s a mean game of horse and carrot, and not a “disruption” that improves industry output and “consumer” satisfaction (doctors in this case are the consumers, and the output is more efficient hospital operation). So yes, we are talking theory here. But, the model’s predictions do match the data–which is that hospitals have spent lots of money on software and seen paltry results.

Live Stream Dr. Josh’s Press Conference On Monday, August 19 @ 1 PM CST

Great news. Dr. Josh has been invited to Skype in to a live press conference held by the Michigan State Government. In case you missed it, state legislators in Michigan have taken a stance for less bureaucratized healthcare. The event will be addressing this topic and related issues. There will be speakers from both House and Senate committees, and professionals in the industry. The speakers will hold a live Q&A afterwards.

The entire event will be both videotaped and broadcast live on Michigan Government TV. You can access the live feed on Monday here. (Look for the August 19 session titled 1PM. If you’re on a desktop, it’s on the top of the left column.)

If you can, please share this post with other doctors you think would be interested. Hope you’ll be tuning in Monday!

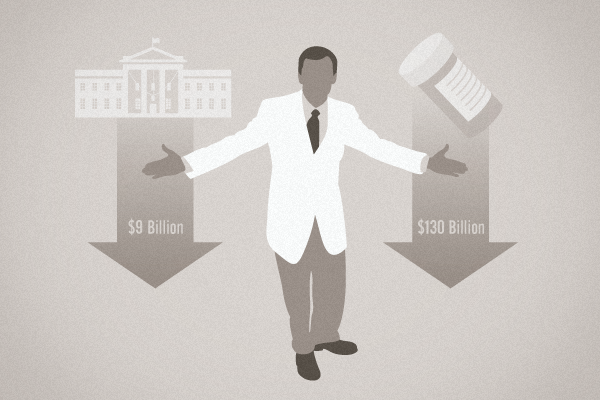

Insurance Exchange Could Save $9 Billion : Insurance-Free Prescriptions Could Save $130 Billion

According to a new collaborative study, “Smart design of health insurance exchanges that will enable Americans to purchase individual coverage under the Affordable Care Act could save consumers and the government more than $9 billion annually.”

The study was called “Can Consumers Make Affordable Care Affordable? The Value of Choice Architecture,” and it tested the ability of consumers to choose the best health insurance plan for their needs without assistance. FierceHealthIT claims, “Most participants struggled to make the most cost-effective choices for themselves and their families.” Which on one hand is just sad, that Americans have trouble buying anything (since it’s safe to say consumer spending drives our country). However, it does draw attention to an inarguable truth out–bureaucracy selling anything tends towards confusing, unfavorable market outcomes. Perhaps part of the reason is the lack of realistic motivators.

Mind The Gap Challenges Docs To Adopt One New Communication Skill

Stephen Wilkins MPH of Mind The Gap recently announced the Adopt One! Challenge. The Challenge, to be launched later the Fall, is encouraging physicians across the U.S. to commit to adopting one new patient-centered communication skill in 2014. If you’re interested in participating, you can sign up here.

One Doctor Searches For Answers To Our Failing Healthcare System

Dr. Michael Painter and his wife Mary each lost a parent. In his wife’s case, her mom died peacefully at home. But Painter’s dad experienced something far more traumatic. He received an early morning call from paramedics regarding his otherwise healthy and vigorous 72-year-old. His dad had fallen at home. Because the responders on the scene presumed a stroke, he was taken to a hospital with a neurosurgery speciality rather than one with a trauma center.

Dr. Michael Painter and his wife Mary each lost a parent. In his wife’s case, her mom died peacefully at home. But Painter’s dad experienced something far more traumatic. He received an early morning call from paramedics regarding his otherwise healthy and vigorous 72-year-old. His dad had fallen at home. Because the responders on the scene presumed a stroke, he was taken to a hospital with a neurosurgery speciality rather than one with a trauma center.

This decision proved fatal.

Man Behind “Meaningful Use” Resigns From High-Ranking HHS Position

According to Modern Healthcare, “Dr. Farzad Mostashari will step down this fall as head of the Office of the National Coordinator for Health Information Technology at HHS, where he’s had a big hand in guiding federal health IT policy for the past four years, including the challenging rollout of meaningful-use rules for electronic health-record systems.” This might sound out of blue, but there’s a reason we’re sharing this–Mostashari brought the phrase “meaningful use” into existence.

According to Modern Healthcare, “Dr. Farzad Mostashari will step down this fall as head of the Office of the National Coordinator for Health Information Technology at HHS, where he’s had a big hand in guiding federal health IT policy for the past four years, including the challenging rollout of meaningful-use rules for electronic health-record systems.” This might sound out of blue, but there’s a reason we’re sharing this–Mostashari brought the phrase “meaningful use” into existence.

A Motivation Advocate Points Out Healthcare’s Lack Of Carrots

François de Brantes is the Executive Director of the Health Care Incentives Improvement Institute (HCI3), and a staunch advocate of incorporating new motivations within healthcare.

François de Brantes is the Executive Director of the Health Care Incentives Improvement Institute (HCI3), and a staunch advocate of incorporating new motivations within healthcare.

According to Brantes, motivation fuels any professional, with morals and ethics steering the ship so to speak. As people, our motivation is to achieve certain goals. And as doctors, we’re guided by at least two primary goals–stay in business and take care of patients. Thanks to falling Medicare payments and rising cost of overhead, though, the staying in business part has taken precedence, and led to primary care physicians bringing on more and more patients. In turn this compromises the more satisfying, and important, concern–making patients healthier. Ideally, if health care professionals were free to realize that second motivation, we’d have a situation where really good care is readily available, and affordable. But that’s not the situation. And it’s clear that something’s gone wrong.

Dr. Josh Breaks Down Every Facet Of Direct Care In His Latest Interview

The Objective Standard spoke with Dr. Josh and captured a comprehensive, and digestible, overview of direct care. The conversation was conducted and transcribed by journalist Ari Armstrong and is currently available as a PDF file for private use and distribution. We’re excited to share it personally through this week’s Atlas MD newsletter (will be included as an attachment). If you haven’t signed up for our weekly direct care updates, you can do so here (make sure to check the newsletter box). Or, if you like, email hello[at]atlas.md to request your copy of the interview.

The Objective Standard is a quarterly periodical written from an Objectivist perspective (Objectivism being Ayn Rand’s philosophy of reason, egoism, and laissez-faire capitalism). Josh’s interview is slated for Fall publication.